Net worth isn’t just a number — it’s a snapshot of your financial health. Whether you’re in your 20s or 70s, understanding your net worth and how it compares to others in your age group can help you plan for the future. More importantly, knowing how to grow it will empower you to build long-term financial security.

Let’s dive into the average and median net worth by age, why these figures matter, and the actionable steps you can take to improve your net worth at any stage of life.

Understanding Average and Median Net Worth by Age

What Is Net Worth?

Net worth is the total value of your assets (cash, investments, property, etc.) minus your liabilities (mortgages, loans, credit card debt).

- Assets include things like your home equity, retirement accounts, savings, and investments.

- Liabilities cover debts such as student loans, car loans, and other financial obligations.

Read our blog post which covers strategies for shielding & preserving your assets.

Net worth naturally evolves with age. Early in life, expenses like student loans and low earnings may keep net worth modest. In middle age, higher incomes and investments often boost wealth. Later in life, net worth may stabilize or decrease as people draw from savings.

Net Worth Benchmarks by Age

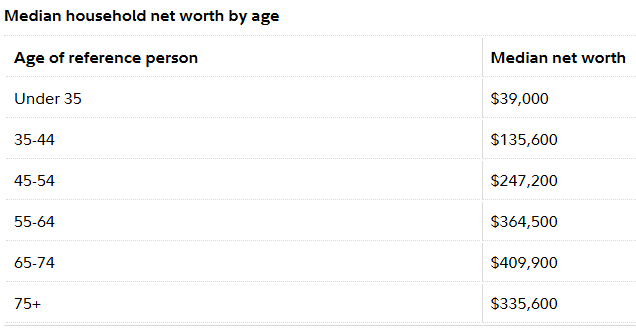

Below are the average and median net worth figures by age group, offering a benchmark for comparison.

Source: Federal Reserve’s Survey of Consumer Finances (SCF)

Keep in mind that when evaluating net worth statistics, the median is often a better representative than the average, which can be significantly skewed by a small number of extremely high-net-worth individuals. In contrast, the median represents the midpoint of the data, meaning half of the individuals have a net worth above it and half below. This makes the median a more accurate reflection of the financial reality for most people.

For instance, while the average net worth may suggest widespread affluence, the median often highlights the financial challenges many face, offering a clearer picture of where the “typical” individual stands within their age group.

Strategies to Boost Your Net Worth

Whether you’re starting from scratch or looking to accelerate your financial growth, these strategies can help you boost your net worth:

Pay Down Debt

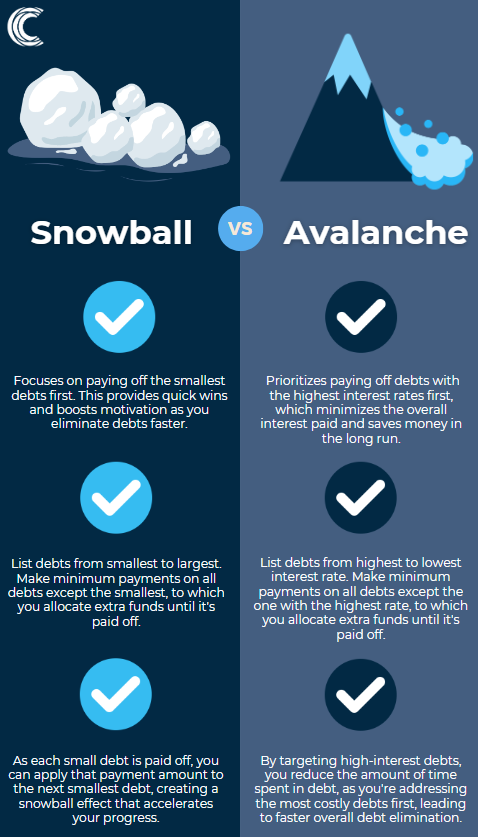

High-interest debt eats away at your net worth, and eliminating it frees up cash for savings and investments.

You could use the avalanche method, which focuses on paying off the highest interest debt first. Or the snowball method, which prioritizes smaller balances to build momentum.

For added efficiency, consider debt consolidation to streamline payments and potentially secure a lower interest rate.

Or you can also use extra income, such as bonuses or tax refunds, to accelerate your repayment efforts and free up cash for savings and investments.

Maximize Retirement Contributions

Retirement accounts are some of the most effective tools for building long-term wealth due to their combination of tax benefits and the power of compound growth.

These accounts allow your investments to grow tax-deferred or even tax-free, depending on the type of account, which can significantly enhance your savings over time.

In 2025, individuals can contribute up to $23,500 to a 401(k), with an additional $7,500 catch-up contribution allowed for those aged 50 or older. For those aged 60-63, the catch-up contribution increases to $11,250, allowing a total contribution of $34,750.

For additional retirement savings, consider an Individual Retirement Account (IRA).

Traditional IRAs provide upfront tax deductions, while Roth IRAs allow for tax-free withdrawals in retirement. The contribution limit for 2025 remains at $7,000, or $8,000 if you’re 50 or older. These accounts complement your employer-sponsored plan, providing additional tax advantages and helping you grow your wealth more efficiently.

Sources: Nerdwallet & Investopedia

Optimize Your Budget

Your spending habits play a crucial role in your financial success. By tracking where your money goes, identifying areas to cut back, and prioritizing savings, you can create a budget that supports your goals.

- Track Expenses: Use a budgeting app to understand where every penny of you money goes.

- Cut Back Where Possible: Cancel unused subscriptions or reduce discretionary spending.

- Automate Savings: Set up automatic transfers to your savings or investment accounts.

Aim to build a budget that prioritizes debt repayment, savings, and investing.

Invest Wisely

Investments are one of the most powerful tools for growing your wealth.

A balanced, diversified portfolio can lead to more consistent returns over time. Regularly reviewing and rebalancing your portfolio ensures your asset allocation stays aligned with your financial goals and risk tolerance.

Diversification is equally important. Spreading your investments across various sectors, asset types, and geographic regions reduces risk and enhances stability.

Additionally, adopting a long-term perspective — rather than trying to time the market — helps you weather short-term fluctuations and focus on sustained growth.

Build an Emergency Fund

An emergency fund is a financial safety net, protecting you from unexpected expenses such as medical bills, car repairs, or sudden job loss. Without one, you may need to rely on high-interest debt, which can erode your net worth.

- Goal: Save 3-6 months’ worth of living expenses.

- Automate scheduled monthly transfers to a dedicated savings account.

- Take advantage of windfalls like bonuses or tax refunds to accelerate savings.

Just remember to avoid dipping into your emergency fund for non-essential expenses.

No matter your age, understanding and improving your net worth is one of the most impactful financial decisions you can make. By comparing where you stand, setting clear goals, and implementing these strategies, you can take control of your financial future.

Remember, it’s not about where you start — it’s about the steps you take to move forward.