As a young adult, it’s easy to feel like you’ve got all the time in the world to figure out your finances. But the truth is, the habits you form now will set the foundation for your financial future.

With 35 U.S. states requiring personal finance education, it’s becoming increasingly clear that financial literacy is no longer a luxury—it’s a necessity.

Yet, even with these strides in education, many young adults still find themselves unsure about managing money, building credit, and staying out of debt. But the good news is that you don’t need a finance degree to take control of your money!

It starts with small, consistent actions.

1. Start With a Budget

Creating a budget may not sound like the most exciting part of being an adult, but it’s absolutely crucial.

Think of it as a roadmap for your money. It tells you where your dollars are coming from and where they’re going—so you’re in control of your spending habits instead of the other way around.

How to Get Started?

- Track all income and expenses for one month to establish a baseline

- Analyze your spending habits

- Categorize the expenses (e.g., housing, groceries, entertainment)

- Set limits for each category based on your individual needs

- Ensure the total expenses don’t exceed your income

Budgeting doesn’t mean restricting yourself; it’s about making sure your money is working for you.

Once you get into the rhythm, you might find budgeting empowering rather than limiting.

Make sure you check out episode 6 of the Money Map podcast where we go over how to become a master budgeter & goal-setter.

2. Build an Emergency Fund

Imagine your car breaks down unexpectedly, or you face an unexpected medical bill.

Without an emergency fund, these surprises can throw your entire financial situation off track. That’s why building an emergency fund is crucial—it’s your financial safety net that gives you peace of mind in stressful times.

Start small. You should aim to save at least three to six months’ worth of living expenses, but don’t be discouraged if that feels overwhelming right now.

Even putting away $25 a month can snowball into something significant over time, especially if you stash it in a high-yield savings account.

Remember, this fund is for emergencies only—so resist the temptation to dip into it for non-essential purchases like a vacation or a new gadget.

3. Pay Off Debt Strategically

Debt is like a weight on your shoulders—it drags you down and makes it harder to get ahead.

And while not all debt is bad, high-interest debt (like credit card debt) can be particularly harmful to your financial goals.

The key to managing debt is having a strategy.

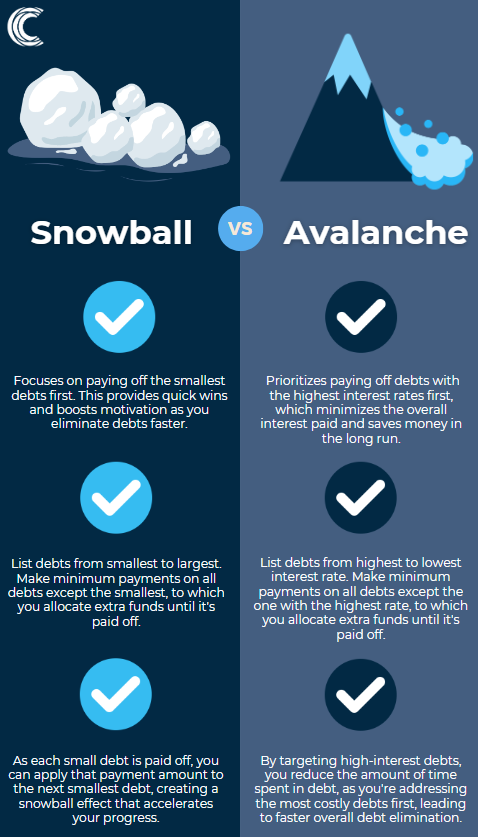

Two Popular Methods:

- Debt Snowball: Pay off your smallest debts first to gain momentum. This is a psychological win—it feels good to cross those smaller debts off your list.

- Debt Avalanche: Focus on paying off debts with the highest interest rates first. This saves you money in the long run by minimizing how much you pay in interest.

Have an approach that works best for you and stick with it, because the sense of relief that comes from being debt-free is truly worth the effort & self-discipline.

4. Save for Retirement Early

Saving for retirement might feel unnecessary when you’re in your 20s. After all, retirement seems like a lifetime away, right?

But here’s a secret: the earlier you start saving, the more time your money has to grow through the magic of compound interest.

Why It Matters?

By contributing to a 401(k) or IRA in your 20s, you give your money decades to grow.

If your employer offers a 401(k) match, take it—that’s essentially free money. Even if you can only afford to invest a small amount each month, starting early gives you a huge advantage over someone who waits until their 30s or 40s.

Read our blog post on the retirement secrets you aren’t supposed to know about to learn more.

5. Use Credit Responsibly

Credit cards can be a double-edged sword.

Used wisely, they’re a tool to build credit, which can help you secure loans for bigger purchases like a car or home in the future. But misuse them, and you could find yourself buried in debt.

Smart Credit Tips:

- Always pay your balance in full each month to avoid interest charges.

- Only use credit cards for necessary purchases, like groceries or gas, rather than splurges.

- Keep your credit utilization ratio low—aim to use less than 30% of your available credit at any given time.

By staying on top of your credit, you’ll build a solid credit score that opens doors to better financial opportunities later in life.

6. Invest in Yourself

Never forget that you are your greatest asset, and investing in your personal development can lead to higher earning potential and more career opportunities down the line.

This could mean enrolling in online courses, earning certifications, or learning new skills that align with your career goals.

Not all investments have to cost a lot of money—many valuable learning resources are available for free or at low cost.

Whether you’re boosting your career prospects or simply broadening your knowledge, the time and energy you spend investing in yourself will pay off in the long run.

7. Understand Your Taxes

Taxes are a reality of working life, and understanding how they affect your income is key to making informed financial decisions.

When you get a job offer or a raise, it’s important to look at your after-tax income, not just the headline salary.

Understanding deductions, tax brackets, and credits can help you make the most of your earnings.

For example, contributing to a 401(k) or IRA can reduce your taxable income, helping you save for the future while lowering your tax bill.

Hear more about 2024 Tax Strategies in the 33rd episode of Wealth Strategies Unleashed.

8. Get Health Insurance Early

You might be young and healthy now, but life is unpredictable.

One medical emergency can lead to thousands of dollars in out-of-pocket expenses if you’re uninsured.

If your employer offers health insurance, take it. If you’re choosing your own plan, look for one that includes a Health Savings Account (HSA).

HSAs allow you to save pre-tax dollars for medical expenses, and the best part? The money rolls over year after year, building a nice cushion for future healthcare needs.

9. Protect Your Assets

As you start to accumulate wealth, it’s essential to protect it. Whether you’re renting an apartment or own a home, having insurance is a smart move.

Key Types:

- Renter’s Insurance: Covers personal property losses due to events like fire or theft.

- Life and Disability Insurance: Provides financial security in case of illness, injury, or death.

As your assets grow, consider consulting a financial advisor to ensure you have the right protections in place.

10. Seek Professional Advice

At some point, you may find yourself feeling overwhelmed by your finances. And that’s okay! There’s no shame in seeking professional advice.

Give us a call at (713) 930-2910 or email us at info@concenturewealth.com if you have any questions or need someone to point you in the right direction! We’d be happy to chat.

Conclusion

Building financial security as a young adult doesn’t happen overnight, but every small step counts. Start with budgeting, build your savings, and make informed decisions about debt and credit. With patience, consistency & strategy, you’ll be well on your way to a brighter, more secure financial future.