Investing in financial markets is rarely a smooth ride, and volatility is something all investors must face at one point or another.

However, it’s important to remember that volatility is normal & is followed by periods of recovery.

Whether it’s due to economic downturns, political instability, or unexpected global events, market volatility can challenge even the most seasoned investors. Learning to navigate these ups and downs without giving in to fear or making hasty emotional decisions is crucial for achieving long-term success.

Check out our recent Money Map episode covering exactly how you can invest through volatility.

Build a Diversified Portfolio

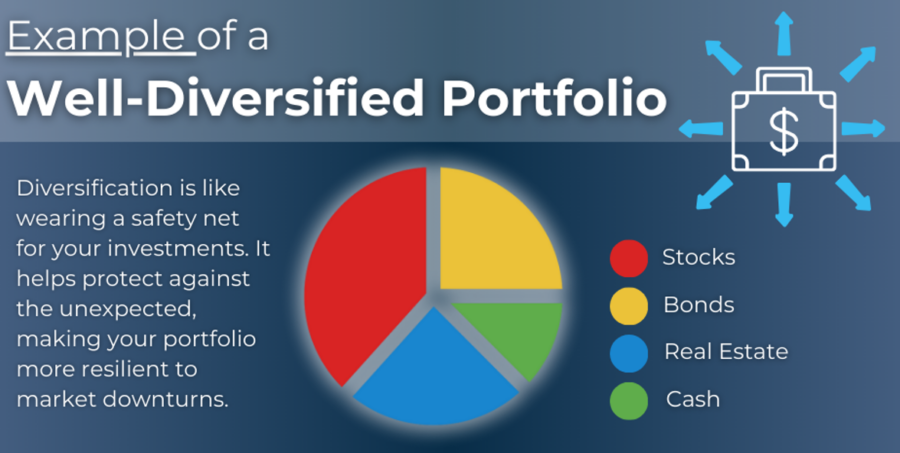

Think of diversification as your safety net. It helps protect your investments from being severely impacted by downturns in one particular sector or asset class.

Ways to Diversify:

- Spread investments across multiple asset classes such as stocks, bonds, and real estate.

- Within those classes, diversify by industry and geography. For example, if you’re invested heavily in U.S. stocks, add some exposure to international markets to balance out regional risks.

Having a diversified portfolio helps protect your investments from the full impact of volatility in any one market. It won’t eliminate risk entirely, but it can minimize it and smooth out your returns over time.

The Psychology of Volatility

At Concenture, we believe that emotions play a huge role in investing. When the market swings, it’s easy to get swept up in the chaos. Fear, greed, and panic can cloud your judgment and lead to impulsive decisions that derail your long-term goals.

During these turbulent times, it’s important to keep your eyes on the bigger picture. Remember, the market has always bounced back from downturns. Instead of reacting impulsively to every dip or surge, try to step back, breathe, and stick to your strategy.

Avoid Panic Selling

Selling in a downturn locks in losses and may prevent you from benefiting from an eventual recovery.

Avoid Over-Optimism

On the flip side, rushing to buy during a surge can lead to overpaying for assets that may soon correct.

Have a plan in place before volatility hits, so you’re less likely to make rash decisions.

Watch Wealth Strategies Unleashed Ep. 6 where our lead advisors discuss emotions & how they impact financial decisions!

Maintain Liquidity in Volatile Times

Liquidity is your safety net during turbulent markets. Liquid assets—like cash or short-term bonds—can quickly be converted into cash without losing value. Having enough liquidity means you can make thoughtful decisions during uncertain times without feeling pressured to sell long-term investments at a loss.

If an opportunity arises, liquidity enables you to act quickly.

In a downturn, having enough liquid assets can help you ride out the storm without needing to tap into more volatile or long-term investments.

Just remember, there’s a balance to strike. Too much liquidity might mean missing out on higher returns, while too little leaves you vulnerable. Aim for a portion of your portfolio that remains easily accessible for emergencies or market opportunities.

Stay the Course with a Long-Term Investment Strategy

When the market gets rocky, it’s tempting to stray from your investment plan. But veering off course can lead to regret. Successful investing is about staying committed to a solid long-term strategy.

Check out last week’s wealth strategies episode on how to be committed to long-term investing in today’s short-term world.

Steps to Stay on Course:

- Review Your Investment Goals: Are you still on track to meet your long-term objectives? If so, there may be no reason to alter your course.

- Resist the Urge to Time the Market: No one can consistently predict market highs or lows, so it’s better to stay invested and ride out the volatility.

- Continue Your Regular Contributions: If you’re regularly investing through a retirement plan or other means, stick with your contributions. Investing during downturns can be especially advantageous because you’re buying at lower prices—a strategy known as dollar-cost averaging.

- Tune out Market Noise: The news can stir up a lot of emotions, but it shouldn’t dictate your investment decisions. Focus on the fundamentals of your portfolio and the reasons you chose those investments in the first place.

Understand the Role of Interest Rates

Interest rates are a major factor that influences market volatility. Changes in interest rates, especially those set by central banks, can impact borrowing costs, consumer spending, and corporate earnings, which in turn affect market performance.

When interest rates rise, borrowing costs increase, slowing down economic growth and corporate profits, which can lead to a market downturn. On the other hand, when rates are lowered, borrowing becomes cheaper, and markets often see a boost.

Key Tip: Keep an eye on central bank announcements and interest rate trends. Shifting investments into sectors like utilities or consumer staples can help shield you from interest rate volatility.

Hear the most recent reactions from Robert Gilliland on the recent fed rate cut news!

Stay Informed Without Overreacting to News

During volatile times, the news can feel like an avalanche.

While staying informed is essential, too much exposure can lead to unnecessary stress and poor decision-making. Remember, markets often react to short-term events, which don’t always reflect the long-term picture. Just because there’s a bad day on Wall Street doesn’t mean you should sell everything.

Reacting to every headline can lead to costly mistakes, like buying high and selling low.

Instead of obsessively tracking every market movement, carve out some time to review news from reliable financial sources. Use this information to confirm—not dictate—your long-term strategy. Discipline is key.

Managing Risk Based on Personal Tolerance

Every investor has a different risk tolerance. Some are comfortable with aggressive strategies, while others prefer a more conservative approach, especially during volatile periods.

Assess Your Risk Tolerance:

- How do you feel during market dips? Are you calm, or do you feel panic setting in?

- Consider your financial goals and timelines. If you need funds in the short term, a high-risk approach may not be appropriate.

Once you’ve assessed your tolerance for risk, adjust your portfolio accordingly. This may involve shifting into safer assets like bonds or cash if volatility is too stressful. However, it’s important to avoid overcorrecting and pulling out of the market entirely. A balance between risk and reward is essential for long-term growth.

Seeking Professional Advice

Navigating volatility can feel overwhelming, especially if you’re trying to manage your portfolio on your own. This is where a financial advisor can offer invaluable assistance. A good advisor can help you separate emotion from strategy, offer insights specific to your situation, and ensure that you’re making decisions that align with your goals.

If you don’t already work with an advisor, now might be a good time to consider it. In periods of volatility, having a professional who understands your risk tolerance and long-term objectives can give you the confidence to stay on track.

While it can be uncomfortable, following a disciplined approach, maintaining a diversified portfolio, and understanding your own risk tolerance can help you navigate these choppy waters of volatility with confidence.

Rather than trying to predict every market move, focus on your long-term goals, keep your emotions in check, and seek advice when needed. By staying informed, prepared, and patient, you can weather even the stormiest of markets and come out ahead over time.