Investing can be a game-changer when it comes to growing your wealth, but let’s be honest — getting started can be intimidating.

Maybe you’re aiming to retire comfortably, buy your dream home, or just want your money to work harder for you. Whatever your goals are, investing can be your ticket to getting there faster if done the right way with care. Let’s break down the basics and help you make sense of it all, so you can dive into investing with confidence and start building the financial future you see for yourself.

The Basics of Investing

Before getting started, it’s important to understand what investing actually is. Investing involves putting your money into financial assets with the expectation of generating a profit. Common investment options include stocks, bonds, mutual funds, and real estate. You’ve probably already heard of some of these.

The goal of investing is to hopefully make your money work for you by earning returns over time.

Key Investing Terms to Know

- Stocks – Shares of ownership in a company.

- Bonds – Loans you make to companies or governments that pay interest over time.

- Mutual Funds – Pooled funds from many investors that are managed by a professional to invest in a diversified portfolio of stocks, bonds, or other securities.

- ETFs (Exchange-Traded Funds) – Similar to mutual funds but trade like a stock on an exchange.

Check out episode 4 of the Money Map podcast where we cover the different investment accounts you can participate in.

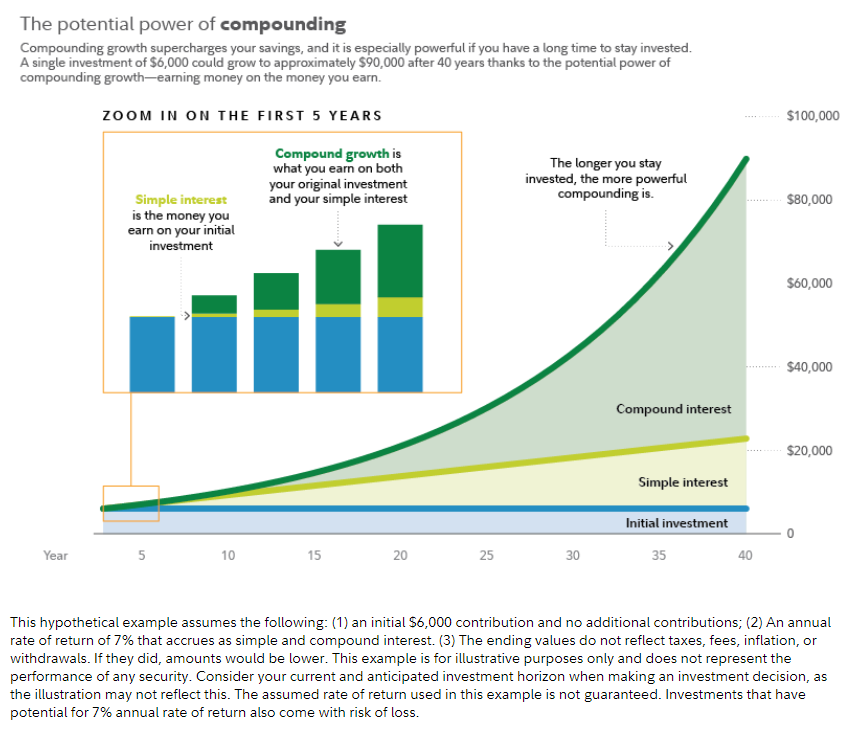

Compound interest is one of the most powerful concepts in investing, and is something beginner investors should be thinking about constantly. It refers to the interest you earn on both the money you invest and the interest that has already accumulated.

Over time, compound interest can significantly boost the value of your investments, especially when left untouched for years. This is why starting early is crucial to maximizing your returns. The longer your money has to grow, the more you’ll benefit from the magic of compounding.

Credit: Fidelity Investments: Learning Center

Set Financial Goals Before You Invest

Before getting started with investing, it’s crucial to take the time to define your financial goals clearly. You might already have a clear vision in your head, but if you’re struggling, it helps to do some introspection.

What do you want your life to look like?

This step lays the foundation for your investment strategy because no two investors are the same — everyone has different financial aspirations, timelines, and risk tolerances.

Ask yourself:

- What do I want to achieve with my investments?

- How much time do I have?

- How much can I afford to invest?

Once you’re able to honestly answer these questions, you’ll be able to effectively align your investment choices with your goals and risk tolerance.

For example, if you’re saving for a short-term goal like buying a home in five years, you might choose safer, less volatile investments. On the other hand, long-term goals, like retirement, allow for more aggressive investment strategies, giving your money more time to grow.

Setting clear financial goals will help you create an investment plan that maximizes your gains without potentially putting yourself in risky situations.

Assess Your Risk Tolerance

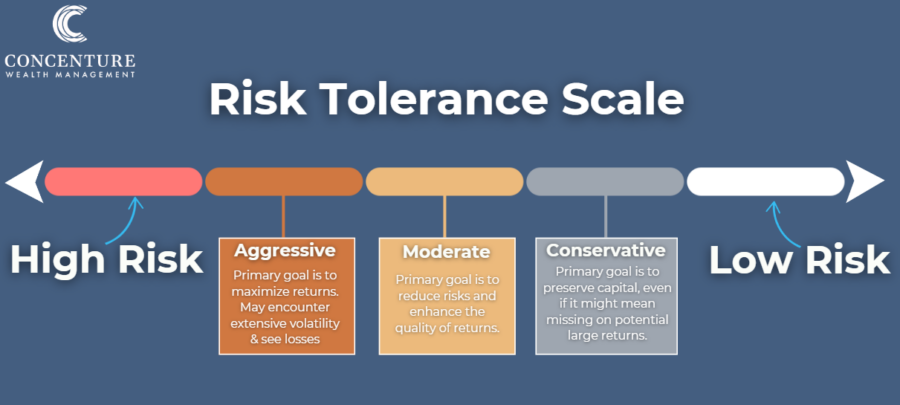

Your risk tolerance is your ability to endure the ups and downs of the market without panicking. Every investment comes with some level of risk, and understanding your comfort level with volatility is key to choosing the right investment types.

Again, this heavily depends on the goals you have set for yourself.

Conservative investors may prefer safer investments like bonds or dividend-paying stocks, while moderate investors may choose a mix of stocks and bonds for both growth and stability. On the other hand aggressive investors are willing to take on more risk for potentially higher returns, often focusing on stocks and more volatile assets.