Ever heard someone in retirement say, “I wish I had started saving sooner”?

That’s the reality for 38% of retirees, and it underscores a common regret among retirees: delaying the initiation of retirement savings.

The good news? If you’re in your 20s or 30s, there’s still time to avoid those same pitfalls and build a future you can feel great about.

Let’s walk through a few common mistakes and how to steer clear of them.

1. Delaying the Start of Retirement Savings

It’s easy to put retirement on the back burner when you’re juggling rent, student loans, or family obligations.

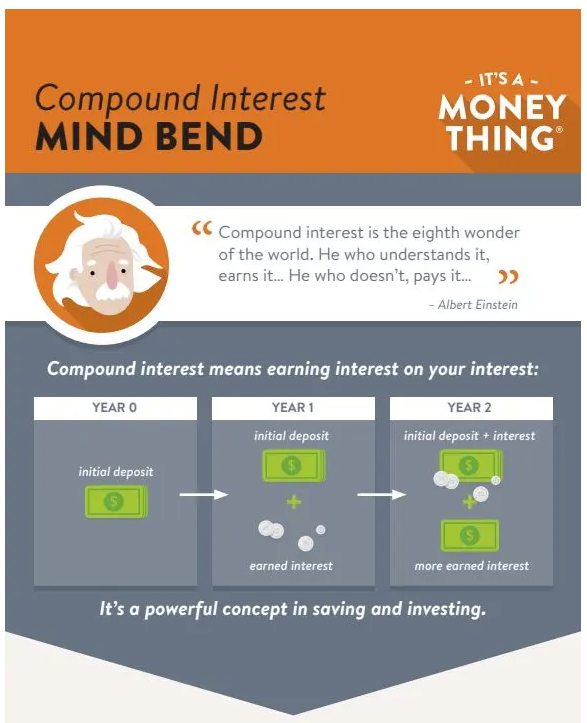

But here’s the deal: even small amounts saved early can grow meaningfully over time due to the power of compound interest.

You don’t have to max out your accounts overnight—just get started. The earlier, the better.

2. Ignoring Employer 401(k) Match Opportunities

Many employers offer matching contributions to 401(k) plans, effectively providing essentially free money to employees who contribute. When you’re mulling over whether or not to take a new job, consider more than just the obvious factors, like salary and paid time off.

As long as you’re financially comfortable with it, aim to contribute at least enough to receive the full employer match.

And while you’re at it, check to see if your employer offers other perks like HSA matches or emergency savings programs. It all adds up.

3. Being Overly Conservative with Investments

Risk feels scary, especially when you’re new to investing.

But when you’ve got decades of compound interest having it’s way before retirement, time is on your side.

Playing it too safe can limit your potential growth, so having a diversified portfolio could help your savings grow more over the long haul.

4. Maxing Out Contributions Too Early in the Year

This one might surprise some people.

If you’re fortunate enough to be maxing out your retirement contributions early in the year, check how your employer match works.

Some, but not all, companies match per paycheck — so if your contributions stop midyear, their match might stop too. In some plans, spreading contributions throughout the year may help you receive the full employer match.

5. Overlooking Alternative Retirement Savings Options

Not all employers offer 401(k) plans.

In such cases, individuals can explore other retirement savings vehicles like Traditional IRAs, Roth IRAs, SEP IRAs, or Solo 401(k)s. These accounts offer various tax benefits and may play an important role in long-term retirement planning.

https://youtu.be/1mp_1lbUrco

6. Thinking retirement accounts are the only investing vehicles needed

While retirement accounts are essential, they often come with contribution limits.

For those looking to save beyond these limits, taxable brokerage accounts can provide an avenue for additional investments. Though they lack the tax advantages of retirement accounts, they offer greater flexibility and no contribution caps.

7. Withdrawing or Borrowing from Retirement Accounts Prematurely

Emergencies happen. But dipping into your retirement funds too soon can mean taxes, penalties, and a serious dent in your future savings.

If you take out money from your workplace savings plan, either as a withdrawal or loan, for cash when you need it, understand that withdrawals are taxed as ordinary income, and if you take a withdrawal before age 59½ you may owe a 10% penalty.

It’s advisable to exhaust other financial resources before tapping into retirement funds to preserve their long-term benefits.

What’s the Takeaway?

The earlier you start and the more intentional you are, the better off you’ll be.

Retirement might feel far off, but the steps you take today have a huge impact on what your future looks like. Avoiding just a few of these common mistakes can put you on a path toward long-term financial freedom.

At Concenture Wealth Management we know that building a secure financial future starts with the small steps you take today. That’s why we offer personalized, goal-driven financial planning designed to meet you where you are and grow with you as life evolves.

Whether you’re just getting started or want to make sure you’re on the right track, we’re here to help you create a plan that supports your goals and the lifestyle you’re working toward.