Election season can stir anxieties and fuel financial frenzy. Breathe easy! Concenture Wealth Management is here to assist you in this time of uncertainty and guide you in your financial decisions. In this guide, we will discuss the important aspects of the election, and their effects on the financial landscape.

Understanding the Election Cycle

The American Political circus often sets the tempo for the financial markets. While the impact of elections on the economy and markets is complex and multifaceted, analyzing different phases of the cycle can reveal historical trends and potential scenarios.

Pre-Election Phase (18-24 months prior)

- This period is marked by heightened policy debate, increased media scrutiny, and potential changes in leadership priorities. The uncertainty surrounding these factors can lead to:

- Increased market volatility: Investors might react erratically to policy proposals, economic data, and polls, leading to short-term market fluctuations.

- Sector-specific shifts: Depending on the proposed policies, certain sectors (e.g., technology, energy, healthcare) might experience increased trading activity and potential price adjustments.

- Defensive positioning: Some investors might choose to shift towards safer assets like bonds or gold as a hedge against potential market turmoil.

Election Phase (6-12 months prior)

- As election day approaches, the rhetoric intensifies, and partisan divides might deepen. This can lead to:

- Short-term market downturns: If polls suggest a potential upset or a close race, market anxiety might rise, leading to temporary dips in stock prices.

- Increased trading volume: Increased interest and speculation can lead to higher trading volume, further amplifying market movements.

- Sector rotation: Depending on the candidates’ stances on specific issues, specific sectors might experience short-term spikes or declines in anticipation of potential policy changes.

Post-Election Phase (First year after election):

- Depending on the election outcome, the following scenarios may unfold:

- “Policy Honeymoon” rally: If the elected candidate’s policies are perceived as favorable to the market, a short-term “honeymoon” rally could occur, boosting stock prices.

- Correction or continuation: If the markets had already priced in the expected outcome, the post-election period might see a continuation of pre-election trends or a mild correction.

- Policy implementation impacts: Depending on the implemented policies, specific sectors might experience sustained changes in performance, either positive or negative.

Historical Trends

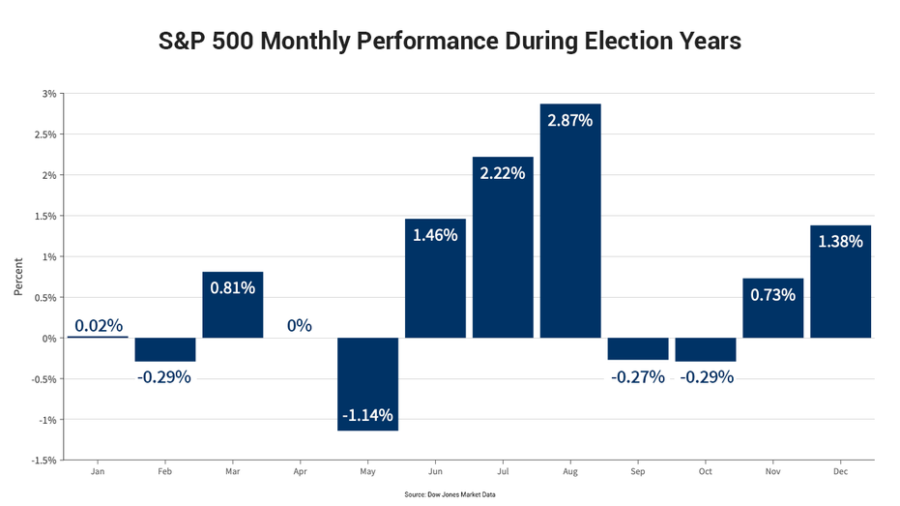

Presidential election years generally show weaker returns in the first year than other years, followed by a rebound in the second and third years. However, an essential factor to remember, historical trends are no guarantees of future outcomes. The market reaction to any specific election will depend on the context and unique circumstances of that time. Below is a chart displaying historical returns of the S&P 500 relative to election years.

The Long-Term Outlook

The presidential election spotlight narrows our focus to the short-term, magnifying every market blip and inflating the importance of any single outcome. Short-term market bumps are inevitable, especially during election years. Don’t let the 2024 election hijack your financial future.

While politicians might capture headlines, it’s their actual policies that impact the economy and, consequently, the markets. Stay focused on the bigger picture, not the political soundbites. Invest in your long-term goals with a cool head and a smart, diversified strategy. Remember, the market has weathered countless elections, and so will your well-planned portfolio. Focus on the policies, diversify your holdings, and keep your eyes on the horizon.

Professional Advice and Consultation

While it’s tempting to navigate the uncertainty of a presidential election alone, remember, you don’t have to fly solo. Seeking professional financial advice during election season can be your ticket to calmer waters and smarter investment decisions. Professional advisors can cut through the election-related hype and focus on what truly matters for your portfolio: your long-term financial goals.

Conclusion

While the relationship between elections and the markets is complex and nuanced, understanding the different phases of the cycle and historical trends can offer valuable insights for investors. Remember, staying informed, diversifying your portfolio, and maintaining a long-term perspective are crucial for navigating the financial landscape during election years and beyond.