Selecting a beneficiary is a crucial part of estate planning.

Whether it’s a retirement account, life insurance policy, or brokerage account, naming a beneficiary ensures your assets are distributed according to your wishes.

However, many people either forget this step or fail to update their designations over time which can lead to legal complications, delays, and even disputes among loved ones.

In this guide, we’ll cover what a beneficiary is, why it’s essential to choose wisely, and how to keep your designations up to date to safeguard your legacy.

What Is a Beneficiary?

A beneficiary is a person or entity (like a charity or trust) that you legally designate to receive the assets in your financial accounts after you pass away.

Beneficiaries can be named on:

✔️ Life insurance policies

✔️ Retirement accounts (401(k)s, IRAs, 403(b)s)

✔️ Brokerage and bank accounts

✔️ Health Savings Accounts (HSAs)

✔️ Trusts and annuities

Without a named beneficiary, your assets may go through probate — a lengthy and costly legal process that decides how your wealth is distributed.

That’s why it’s critical to keep your beneficiary designations updated.

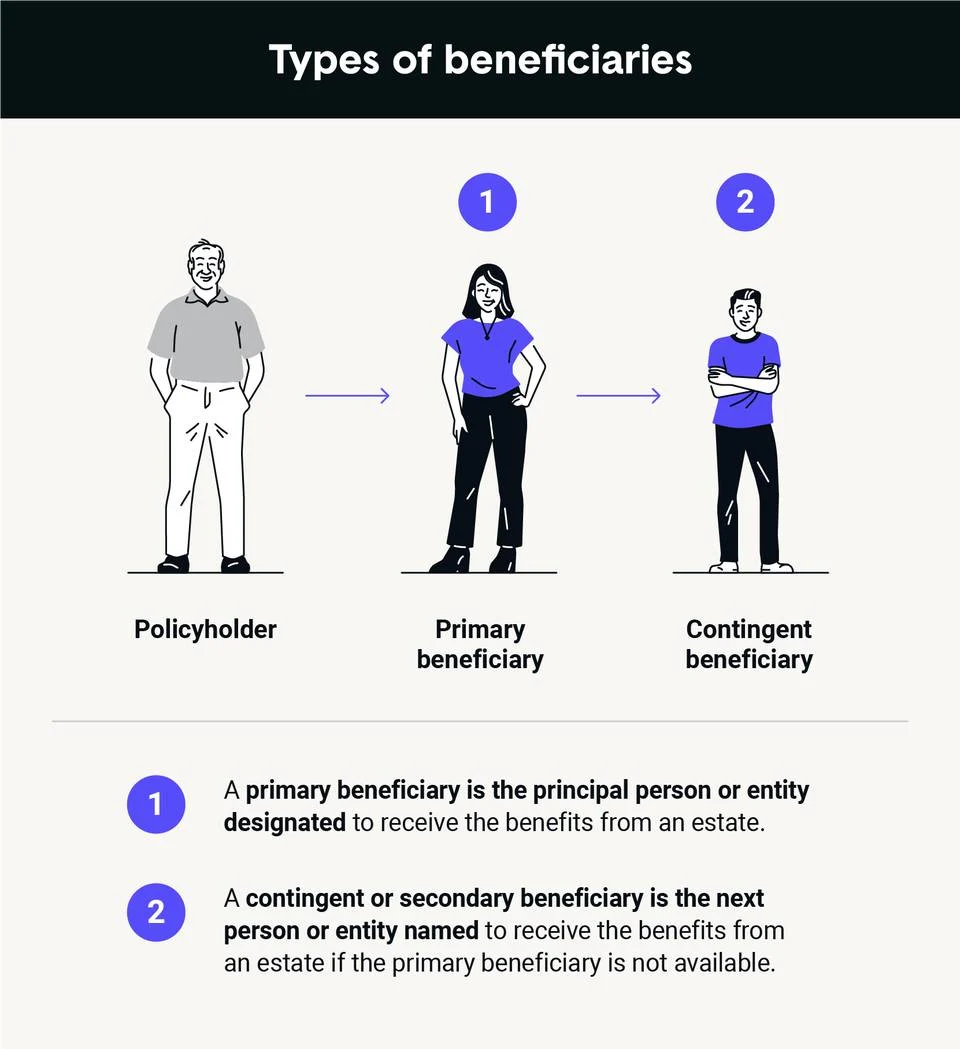

Primary vs. Contingent: What’s the Difference?

Primary Beneficiary

Your primary beneficiary is the first in line to inherit your assets. This could be your spouse, children, a family member, or even an organization.

Contingent Beneficiary

A contingent beneficiary is a backup in case your primary beneficiary is unable to inherit the assets. If your primary beneficiary is deceased, unreachable, or declines the inheritance, the assets automatically transfer to the contingent beneficiary.

Example: You name your spouse as your primary beneficiary and your child as your contingent beneficiary. If your spouse passes away before you, your child receives the assets instead.

Having both primary and contingent beneficiaries ensures that your wealth is transferred smoothly without delays.

Who Should You Name as a Beneficiary?

Choosing a beneficiary depends on your personal and financial circumstances. Here are some common options:

Spouse or Partner

For many, a spouse or long-term partner is the primary choice, ensuring they have financial security after your passing. If you’re married, your spouse is often the default beneficiary on retirement accounts and insurance policies unless you specify otherwise.

Children & Family Members

Another common option is children and other family members. However, if you plan to leave an inheritance to minors, consider setting up a trust to control when and how they receive the funds.

This ensures responsible management of assets, especially for younger heirs who may not be ready to handle a large sum of money.

Charitable Organizations

Beyond family, some individuals choose to leave a legacy by naming charitable organizations as beneficiaries. Whether it’s a cause you’re passionate about or a nonprofit you’ve supported for years, designating a charity can be a meaningful way to give back.

Trusts

For those looking for more control over how their assets are distributed, trusts offer a structured approach. A trust allows you to set specific terms on when and how beneficiaries receive their inheritance, making it a smart option for complex estate planning.

Important Note: Minor children cannot directly inherit retirement accounts or life insurance proceeds. If no trust is in place, the court will appoint a custodian to manage the funds until they reach legal age. To avoid complications, setting up a trust ensures that assets are distributed according to your wishes.

Can You Name More Than One Beneficiary?

Yes! Most financial accounts allow multiple beneficiaries. You can also divide your assets however you like.

For example:

- 50% to your spouse

- 25% to your child

- 25% to a charity

If a beneficiary passes away before you, their share is typically distributed among the remaining beneficiaries — unless you specify otherwise.

How to Add or Update a Beneficiary

Adding or updating a beneficiary is usually quick and easy. Here’s how:

1️⃣ Log into your financial account – Most banks, investment firms, and insurance providers let you update beneficiaries online.

2️⃣ Locate the beneficiary section – Find the area where your current designations are listed.

3️⃣ Add or change a beneficiary – Enter their full name, date of birth, relationship to you, and Social Security number (if required).

4️⃣ Choose allocation percentages – If you have multiple beneficiaries, decide what portion each should receive.

5️⃣ Save and confirm – Some institutions require a final confirmation or paperwork submission.

Pro Tip: Notify your beneficiaries about your decision so they’re aware of what to expect in the future.

Naming a beneficiary is a simple but powerful step in protecting your assets and ensuring your loved ones are taken care of. Without one, your estate could get tied up in legal battles, unnecessary expenses, and distribution delays.

Regularly review and update your beneficiaries — especially after major life events like marriage, divorce, or the birth of a child.

Consider working with an estate planning professional to make sure your designations align with your overall financial goals.

Communicate with your beneficiaries so they understand your wishes and can prepare accordingly.

A little planning now can make a huge difference for your loved ones in the future. Start reviewing your beneficiary designations today!