Can a Personalized Investment Strategy Optimize Your Portfolio?

The traditional 60/40 portfolio may no longer cut it. Between inflation, rising interest rates, and unpredictable markets, many investors are looking for a smarter way to invest.

But the best approach isn’t about finding the next hot trend. It’s about building a strategy that actually fits your life.

Here’s how a personalized investment plan can help you optimize returns and reduce stress.

Table of Contents

- What Is a Personalized Investment Strategy?

- How Can I Understand My Risk Tolerance?

- Which Investment Goals Should Drive My Portfolio Strategy?

- Should My Investment Strategy Change Over Time?

- What Are the Benefits of Working With a Professional Advisor?

What Is a Personalized Investment Strategy?

A personalized investment strategy tailors your portfolio to your unique goals, time horizon, income needs, and risk tolerance. Rather than relying on outdated models or generic recommendations, your allocation is built around your financial reality.

Why does this matter?

-

Life goals and timelines vary widely.

-

Market conditions change quickly.

-

Cookie-cutter approaches don’t reflect your full picture.

At its core, personalized investing aligns your money with what you want your future to look like, and makes sure your portfolio supports that vision at every stage.

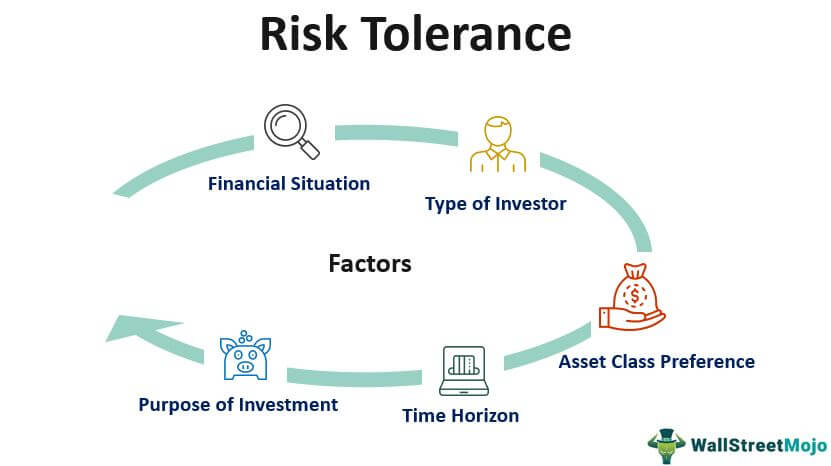

How Can I Understand My Risk Tolerance?

Understanding your risk tolerance is foundational to building an investment strategy that actually works for you—not just on paper, but in real life.

While many investors are quick to categorize themselves as “aggressive” or “conservative,” the truth is, risk tolerance is nuanced and can shift depending on your stage of life, financial goals, and even your past investment experiences.

- A common guideline like the Rule of 100 suggests subtracting your age from 100 to estimate the percentage of your portfolio that might be allocated to equities. So for example, a 40-year-old might consider 60% equity exposure.

Ultimately, a formula like this is just a guideline and starting point. A personalized approach goes deeper, exploring your ability to handle market swings emotionally, your liquidity needs, and how your portfolio fits into your broader financial plan.

Working with an advisor helps translate your abstract preferences into a clear and functional investment strategy.

Which Investment Goals Should Drive My Portfolio Strategy?

Investing isn’t just about returns. It’s about funding the things that matter.

Some examples of goal-aligned investing:

-

People building wealth in their 30s or 40s may want a more aggressive growth strategy.

-

Pre-retirees may shift toward stability, income, and tax efficiency.

-

Legacy planners may need advanced strategies involving trusts, real estate, or donor-advised funds.

Your strategy should support your real-life objectives, whether that’s buying a vacation home, supporting family, or leaving a legacy.

Without that alignment, even the best-performing portfolio may feel like it’s falling short.

Should My Investment Strategy Change Over Time?

Yes, because your life changes as well.

The investment strategy that suits you at age 35 likely won’t serve you as well when you’re 65. Your time horizon gets shorter, your goals become more focused, and your tolerance for risk may shift as retirement nears.

But beyond those life-driven changes, even the broader market environment evolves, and often requires adjustments in how your portfolio is structured.

Inflation, interest rates, tax policy, and even technological innovation can all influence which asset classes perform well in a given year.

Staying static in a dynamic environment can lead to missed opportunities or unnecessary risk.

That’s why portfolio optimization isn’t a one-and-done exercise. It requires regular reviews, active rebalancing, and a willingness to make changes based on both your financial trajectory and what’s happening in the broader economy.

Working with a professional can help ensure those updates are strategic, not emotional, and always tied back to your long-term goals.

What Are the Benefits of Working With a Professional Advisor?

A strong investment partner brings clarity and structure to your strategy—without the stress of DIY guesswork.

What do you gain by working with a fiduciary advisor?

-

A clearly defined framework to guide investment decisions

-

Ongoing check-ins to ensure your strategy stays on course

-

Real-world insight across multiple market cycles

-

Help navigating emotional decisions and market swings

At Concenture Wealth Management, we don’t believe in one-size-fits-all portfolios. We believe in plans built around your unique goals, values, and timeline.

Whether you’re early in your journey or refining a more complex portfolio, our team is here to help you build a strategy that truly works for you.

Connect with us today to start optimizing your portfolio with a plan that’s personal, flexible, and built to last.