Retirement is meant to be a time of freedom, excitement, and new possibilities. But many retirees look back and wish they had made different choices along the way.

The good news? You don’t have to make the same mistakes.

With a little planning, smart decision-making, and a clear vision for your future, you can sidestep some of the most common regrets and create a life you’ll truly enjoy.

Regret #1: Waiting Too Long to Travel

Many retirees dream of traveling the world.

But too often, they put it off — waiting for “the perfect time.”

Unfortunately, by the time they’re financially ready, health issues may limit their ability to fully enjoy it.

How to Avoid This

- Prioritize travel early in retirement – The first 10-15 years are often called the “go-go years” because you’re still active and able to explore. Don’t waste them!

- Budget for travel ahead of time – Factor it into your retirement savings plan so you’re prepared.

- Look for affordable ways to travel – Consider off-season trips, house-sitting opportunities, or using rewards points to cut costs.

If seeing the world is important to you, make it a priority early on while you still have the energy to enjoy it.

Regret #2: Not Having a Plan for “What’s Next”

Leaving the 9-to-5 behind sounds amazing. But what happens after you retire?

Many retirees struggle with boredom, loss of identity, and a lack of purpose. Without a plan for how to spend your days, retirement can start to feel empty.

Ways to Prevent This

- Find hobbies that excite you – Retirement is the perfect time to explore that passion you never got around to, whether it’s painting, woodworking, learning a new language, etc.

- Consider part-time work or volunteering – Many retirees find fulfillment in consulting, mentoring, or giving back to their communities.

- Structure your days – While you don’t need a strict schedule, having some kind of daily or weekly routine can help you stay engaged and active.

Retirement isn’t just about leaving work. It’s about finding something new to move toward.

Regret #3: Losing Touch with Friends

Work provides built-in social connections.

When you retire, those relationships often fade — unless you make an effort to maintain them. Unfortunately, loneliness is a common issue among retirees.

And it can have real consequences, from increased health risks to reduced life satisfaction.

✔ Stay Connected

Before you retire, make a conscious effort to reach out and strengthen your social circle. Don’t wait until you leave work to start nurturing friendships outside of the office. Building connections ahead of time ensures that you won’t feel isolated once your daily work interactions fade.

✔ Join Groups & Clubs

Retirement is the perfect time to explore new interests while meeting like-minded people. Whether it’s a local hiking group, a book club, a fitness class, or a community volunteer organization, getting involved in structured social activities keeps you engaged and provides a sense of belonging,

✔ Schedule Meet-Ups

Friendships take effort, and maintaining them requires intentionality. Take it upon yourself to be the one who initiates plans and stays in touch. Set a recurring coffee date, lunch, or dinner with old friends, even if it’s just once a month.

Regret #4: Not Talking to Your Spouse About Retirement Plans

Retirement isn’t just an individual transition — it’s a shared experience for couples. And not having open conversations about it can lead to pent-up frustration.

One spouse might want to travel the world nonstop while the other wants to relocate.

How to Avoid This

- Start the conversation early and talk about your expectations well before retirement.

- Plan activities together by finding shared hobbies or experiences that you both enjoy.

- Be open to compromise, because a little flexibility goes a long way in ensuring both partners are happy.

Aligning your retirement vision before you retire will make the transition smoother — and your relationship stronger.

Regret #5: Underestimating Healthcare Costs

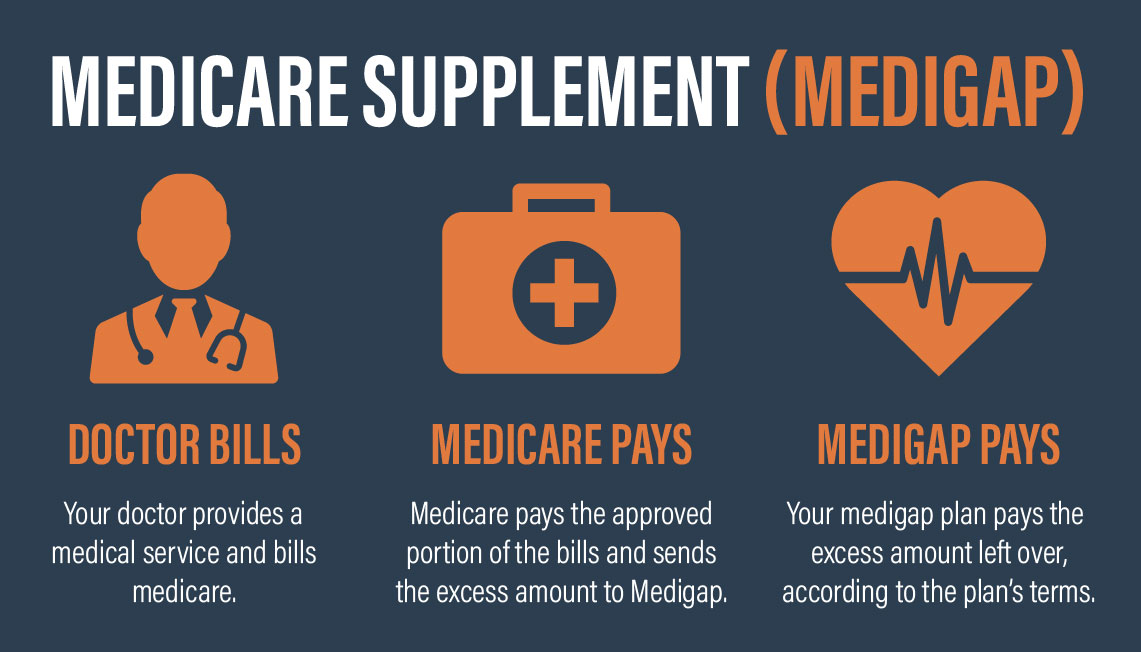

Many retirees assume Medicare will cover all their medical expenses.

It won’t.

From out-of-pocket costs to long-term care, healthcare can be one of the biggest financial burdens in retirement.

Budget for Medical Expenses

Healthcare can be one of the biggest expenses in retirement. Factor anticipated medical costs into your retirement savings strategy, including doctor visits, prescription medications, and potential long-term care needs.

Look Into Supplemental Insurance

Medigap policies can help cover out-of-pocket expenses like copays and deductibles, while long-term care insurance can protect against the high costs of assisted living or nursing home care. Researching your options early can help you secure better coverage at a lower cost.

Stay Healthy

The best way to reduce healthcare costs is to prioritize your well-being. Regular exercise, a balanced diet, and preventive screenings can help keep medical issues at bay and minimize expensive treatments down the road.

Plan Now, Enjoy Later

Retirement is supposed to be a time of freedom, adventure, and relaxation. But without proper planning, it can also come with unexpected regrets.

By being proactive about travel, social connections, financial decisions, and healthcare, you can set yourself up for a truly fulfilling retirement.

Take action today:

- Review your retirement plans and adjust where needed.

- Have open conversations with your spouse and loved ones.

- Start making intentional decisions that align with the retirement lifestyle you truly want.

- Talk with a Financial Advisor to help get you and your family set up with a plan.