Summary:

Retirement comes with its fair share of misconceptions, and believing them can delay your plans or lead to unnecessary anxiety. In this episode of Wealth Strategies Unleashed, Robert Gilliland & Karen Heider tackle 3 of the biggest retirement myths, and share 5 practical steps you can take to retire when you want to, with the confidence that you’re financially ready.

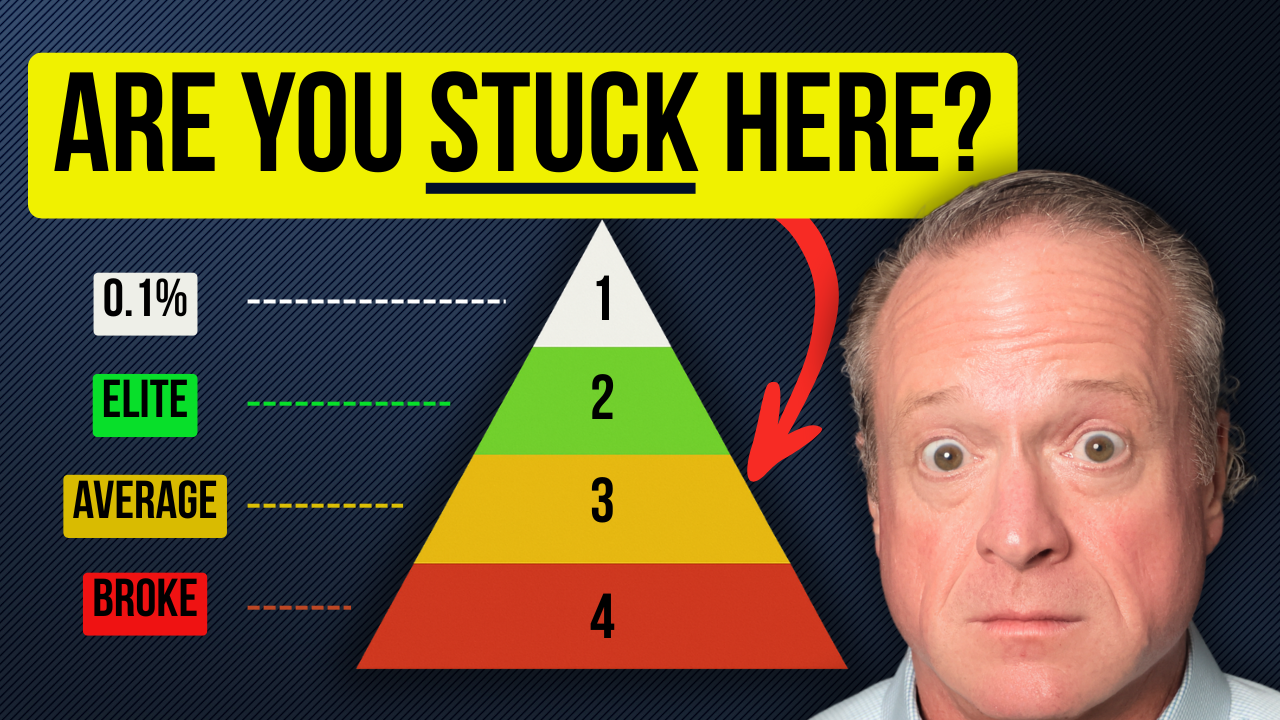

From the false idea of a “magic number,” to the “just one more year” trap, to comparing your lifestyle with others, this conversation blends real-world planning strategies with behavioral insights so you can make informed, intentional decisions about your retirement timing.

We share actionable ways to:

-

Break free from the myth of a single “retirement number” by focusing on outcomes and income streams

-

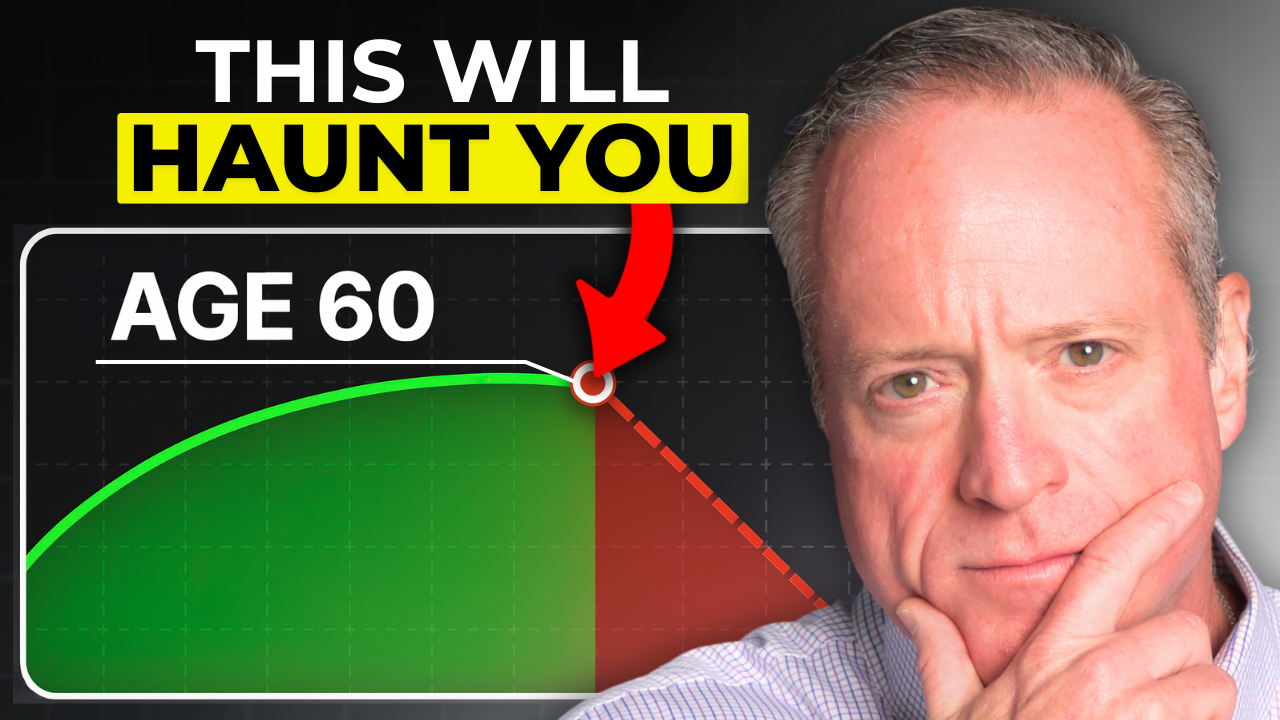

Avoid the “one more year” mindset by planning ahead and defining how you’ll spend your time in retirement

-

Use the right tools like budgeting, guaranteed income analysis, and safe reserves to build a sustainable plan

-

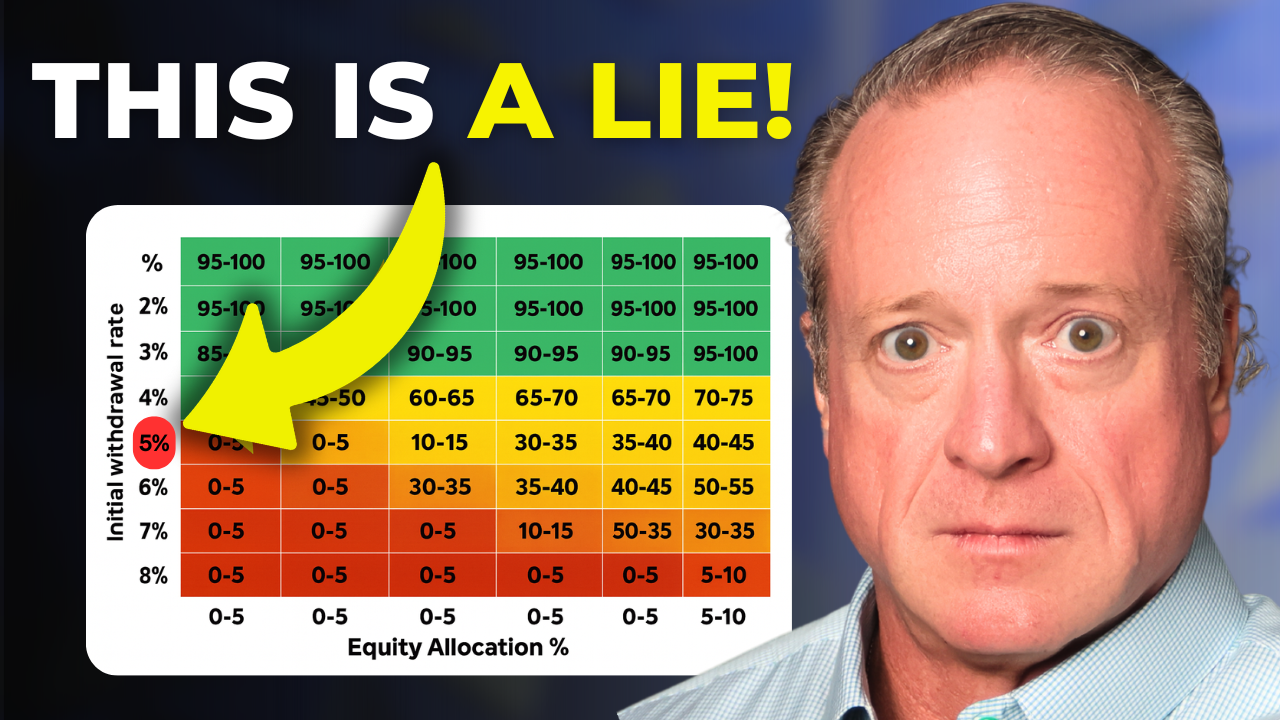

Stress-test your portfolio for market volatility and sequence-of-return risk before you step away from work

-

Consider a phased retirement or part-time work to ease the emotional and financial transition

Download the free guide that we’ve paired with this episode!

Subscribe, and leave us a review if this resonated with you!

Share it & leave us a review on Apple or Spotify!

For personalized financial guidance, schedule an intro call with our team at Concenture Wealth Management in Houston, Katy, & Spring, TX. Our team of professionals can provide advice and help you navigate how to invest your wealth and plan for your retirement. We’d love to help you live out your legacy! To explore our 3-step process and services we offer click here.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation. This work is powered by Concenture Wealth Management. Registered Representative of Sanctuary Securities Inc. and Investment Advisor Representative of Sanctuary Advisors, LLC.- Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. – Advisory services offered through Sanctuary Advisors, LLC., an SEC Registered Investment Advisor. – Concenture Wealth Management is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.